Donating Your Car in Las Vegas: The Ultimate Guide

Most people don’t realize how easy it is to donate their car in Las Vegas. The process is actually quite simple, and it can have a huge impact on the lives of those in need. Here are a few easy steps to follow if you’re interested in donating your car:

1. What to do when you want to donate your car in Las Vegas

First, do some research to find a charity you feel strongly about that accepts car donations. One to consider is the Paralyzed Veterans of America Nevada Chapter here is Las Vegas. Most other charity programs are handled by national call centers and simply dispatch tow drivers to pick up vehicles. Those vehicles are then typically taken in their broken state to dealer only auctions and sold to the highest bidder.

The Nevada PVA on the other hand assesses and repairs your vehicle if needed then sells it at a Las Vegas public car auction. This equates to the charity getting more money. You in return get a larger tax benefit because it is based off the sale price, and a member of the public gets a much needed affordable car option.

2. How to find a reputable charity that will accept your car donation

You’ve finally decided to get rid of that old car. But rather than trading it in or selling it, you want to donate it to charity here in Las Vegas. After all, donating your car is a great way to give back to the community and potentially receive a tax deduction. But how can you be sure that your donation will go to a reputable charity?

There are a few things you can do to research charities before you donate your car. First, check out the charity’s website. Does it provide clear information about its programs and how donations are used? Next, contact the charity directly and ask questions about its car donation program. Finally, look for online reviews of the charity. If you see a lot of negative reviews, that’s a red flag.

By taking the time to do your research, you can be confident that your donation will go to a worthy cause.

3. What kind of tax benefits you can expect from donating your car

When you donate your car to a reputable charity, you can feel confident that you are making a difference while also getting a tax deduction. The first step is to make sure the charity is qualified to receive tax-deductible donations. Once you have verified this, you will need to get an appraisal of your vehicle. The appraised value will be the amount you can deduct from your taxes.

I your vehicle is broken or not running the appraised value might only be $200 – $400 depending on the condition. However here in Las Vegas you may be able to leverage your tax deduction if you donate to Paralyzed Veterans of America, Nevada chapter. Here’s how.

Paralyzed Veterans of America in Las Vegas fix most of the donated vehicles first before they sell them. Then they are sold at a public auction, not just a dealer only auction giving them a larger reach. The result is an average sold vehicle price of $2,200.00 instead of $200 – $400 that you can write of on your taxes.

You can obviously donate your vehicle to any charity you want but if you are interested in the largest tax benefit the Nevada PVA is a great option. Plus since it is a local chapter all of the proceeds stay here in Nevada instead of being distributed around the country.

Keep in mind that the charity must sell the vehicle in order to provide services; they cannot give it away or use it for themselves. If you have any questions about the process, be sure to consult with a tax professional.

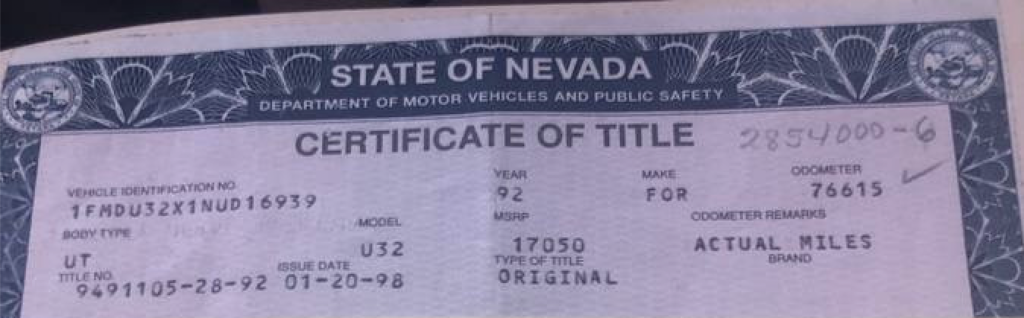

4. Documents you’ll need to donate your car

When you’re ready to donate your car, there are a few documents you’ll need to have in order. First, you’ll need a clear title or proof of ownership. This is important because it ensures that the vehicle can be legally transferred to the charity of your choice. Secondly, you’ll need a valid driver’s license. This is necessary in order to sign over the title and registration at the time of donation.

If you are donating on behalf of a loved one who has passed away you will need a copy of the legal documents appointing you as the executor of the estate. In addition you will need an original copy of the death certificate to go with it.

By having these documents on hand, you can make the car donation process quick and easy.

5. How the donation process works

Here is the easy part! Simply contact the charity of your choosing to schedule a time for them to pick up your car. They will usually come to your home or office to tow the vehicle away. Typically there is now charge for the removal of the vehicle. If you are asked to pay for pickup you may want to consider a different charity.

Finally, fill out any necessary paperwork and be sure to get a receipt for your donation. This can be used for tax purposes.

6. After your car is donated, what happens next

In most cases after you donate your car, it will be picked up by a tow truck and taken to a dealer only car auction. This is the most common method nationally because it is the easiest way to do it. Unfortunately it is not always the best for you as the donor.

As stated before in the case of the Paralyzed Veterans of America local Las Vegas chapter it is different. When donating to them your car will be picked up by a tow truck and taken to a donation processing center not a dealer auction. There, the car will be inspected to make sure it is in running condition. Once the car has had any needed repairs and passes inspection, it will be sold at a public auction.

In either case the proceeds from the sale of the car will be used to support the charity’s programs and services. It just happens that your tax deduction may be higher in scenario #2. In some cases, the car may be sold to a salvage yard for parts. If the car is not suitable for sale, it will be recycled. The metal from the car will be melted down and reused to make new products. The plastic and rubber parts will be recycled into new materials and the cycle continues again.

Conclusion

Donating your car to charity is a great way to get a tax deduction and help a worthy cause. We’ve outlined the process for you and provided some tips on what documents you’ll need. Keep in mind that each charity operates differently, so be sure to contact them directly to find out how the donation process works.

We hope this article has helped make donating your car easier than ever. Thank you for considering giving back to those who need it most!